What is Zakat in Islam?

Everything You Need To know

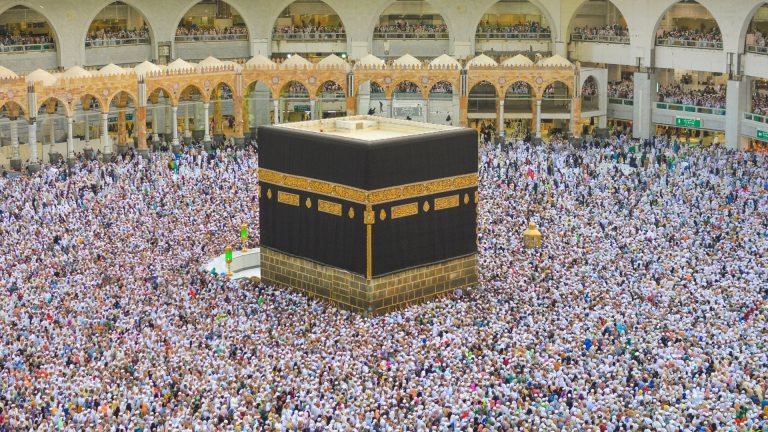

The five essential pillars of Islam are the shahada (Tawhid), salat, zakat, sawm, and hajj. Every Muslim is obligated to uphold these pillars and live a life of purity in their hearts. Zakat, the third pillar, mandates that individuals give a portion of their wealth to the poor and needy.

This act of charity is a form of worship and a way to follow the path shown by Allah. Only those who are eligible must pay zakat as a religious obligation, and it is not mandatory for everyone to donate annually. Learn all about Zakat in Islam, its significance, types, benefits, rules, calculation, and more.

What is Zakat in Islam?

Zakat, derived from the Arabic word meaning “to increase” or “that which purifies,” is a fundamental principle in Islam. It involves giving a portion of one’s wealth each year to help purify and bless the remainder of their earnings.

This obligation applies to excess wealth, including money in bank accounts or at home, possession of gold or silver, agricultural produce, livestock earnings, and profits from stocks and investments. By giving zakat, individuals are freed from greed and selfishness, promoting peace and harmony in society.

Importance of Zakat in Islam

Zakat in Islamis a cornerstone practice, is underscored in the Quran over 80 times. It mandates that individuals calculate and contribute it with sincerity, a practice that deepens their spiritual connection with Allah, the ultimate truth. Beyond its spiritual significance, Zakat plays a pivotal role in upholding societal harmony and alleviating poverty.

By ensuring a fair redistribution of wealth, Zakat helps to combat social ills such as slavery, exploitation, and crime. This annual donation not only serves as a pillar of individual faith but also fosters a sense of brotherhood and Muslim unity on a global scale, all in the name of Allah, the almighty.

Types of Zakat

There are two primary types of Zakat in Islam:

1. Zakat al-Mal

This is the most common form of Zakat, involving the annual donation made on an individual’s wealth. This wealth can include cash, gold, silver, and property.

2. Zakat al-Fitr

Another important obligatory donation for Muslims is zakat fitrah. It must be given before Eid within a specified time frame to be valid.

Zakat Hadith

In a hadith narrated by Abu Huraira, the Prophet Muhammad (peace be upon him) mentioned the virtues of charity, likening it to an investment with extraordinary returns.

He said that if someone gives in charity even the equivalent of a single date-fruit from their honestly earned money, and Allah accepts it, Allah takes it in His right hand and magnifies its reward for that person. The reward grows like a baby horse nurtured until it becomes as massive as a mountain.

Benefits of Zakat in Islam

Here are the benefits of ZAKAT.

1. Unification in the Cause of Allah

Charity in the name of Allah, specifically through the practice of Zakat, holds numerous benefits for both individuals and society at large. One of the key aspects of Zakat is its ability to unify individuals in the cause of Allah. According to a Hadith, an angel prays to Allah for the well-being and sustenance of those who contribute to charitable causes, indicating a spiritual connection between the giver and the divine.

2. Protection from Hellfire

Moreover, giving Zakat is believed to offer protection from hellfire. Allah rewards those who demonstrate righteousness and obedience, and fulfilling the obligation of Zakat is seen as a demonstration of such qualities. It is believed that those who fulfill their Zakat obligations will find safety from hellfire and will be provided with a home on the Day of Judgment.

3. Promotion of Belongingness in Society

On a societal level, Zakat promotes a sense of belonging and unity. By ensuring the equitable distribution of wealth, Zakat uplifts the poor and needy, reducing the social disparity between the rich and the poor. This helps create a more harmonious and just society, where every individual is valued and supported, mirroring the equality that Allah has ordained for all human beings.

4. Encouragement of Generosity and Empathy

In addition to these benefits, practicing Zakat encourages generosity and empathy among individuals, fostering a culture of giving and compassion. It also serves as a reminder of the transient nature of wealth and the importance of sharing resources with those in need, reinforcing the values of humility and gratitude.

Zakat Rules In Islam

Zakat, an annual donation in Islam, has specific rules that every Muslim should know. Here are the key rules:

1. Eligibility for Zakat

Individuals must donate wealth if their annual income exceeds a certain minimum amount (nisab). This donation becomes an annual obligation once the nisab threshold is reached. Zakat should not be delayed, as it is a responsibility.

2. Zakat al-Fitr

This is a donation paid by the head of the family at the end of Ramadan for every fasting member of the family. It can be given in terms of money or food, equivalent to the amount of one-day fasting for each member.

3. Eligibility to Give Zakat

Zakat becomes due when a person’s wealth exceeds the nisab.

4. Nisab

The nisab is the minimum amount of wealth at which an individual is required to pay Zakat. Different sources and assets have different calculations for nisab. If an individual’s wealth drops below the nisab during the Zakat year, the calculation restarts once the wealth exceeds the nisab again.

5. Eligibility to Receive Zakat

There are eight categories of people who can receive Zakat:

How to calculate Zakat?

Zakat is a significant pillar of Islam, emphasizing the importance of charity and helping those in need. To calculate Zakat, you first need to determine your Zakatable income by adding all sources of income such as gold, silver, cash, stocks, shares, and property. Next, calculate your needs and living expenses for the year and subtract this from your total income to find the Zakatable amount.

If this amount is above the threshold (nisab), multiply it by the Zakat percentage to find the yearly donation. However, if the Zakatable amount is less than the nisab, no donation is required.

For Zakat on salary, calculate the Zakat on your savings from your salary. If your savings are over the nisab, you must pay the donation. If your salary varies, calculate the total amount saved over the year and pay the donation accordingly.

Zakat Facts

Some important facts about Zakat include:

In essence, Zakat is an obligation on Muslims to protect the poor from the evils of greed and wealth. It helps maintain balance and order in society by replacing immoral acts with goodness and truth. Pay your obligatory donation according to your ability and contribute to restoring prosperity to the Ummah.

FAQs

What is the purpose of Zakat in Islam?

Zakat serves several purposes in Islam. It is a means of purifying one’s wealth and soul, fostering empathy and solidarity among Muslims, and providing for the less fortunate in society. It also helps to maintain social and economic balance by redistributing wealth and preventing the accumulation of wealth in the hands of a few.

Who is obligated to pay Zakat?

Every Muslim who possesses wealth above a certain threshold (nisab) is obligated to pay Zakat. This includes cash, gold, silver, and other assets that are held for a full lunar year and exceed the nisab value.

Can Zakat be given to non-Muslims?

Zakat cannot be given to non-Muslims unless they are new converts to Islam, as Zakat can be used to strengthen the faith of new Muslims (muallaf). However, general charity (sadaqah) can be given to non-Muslims in need.

Is there a deadline for paying Zakat?

Zakat should be paid as soon as it becomes due, which is typically at the end of the Islamic lunar year. It is encouraged to pay it early to fulfill the obligation promptly and benefit those in need sooner.

What happens if someone does not pay Zakat?

Failure to pay Zakat is considered a sin in Islam and can have spiritual consequences. It is important for Muslims to fulfill this obligation to maintain purity in their wealth and uphold the pillar of Zakat.

Conclusion

Zakat is a fundamental pillar of Islam that emphasizes the importance of charity, solidarity, and social justice. It is not only a means of purifying one’s wealth but also a way to uplift the less fortunate and foster a sense of community and empathy among Muslims. By fulfilling the obligation of Zakat, Muslims can contribute to a more equitable and harmonious society, in accordance with the teachings of Islam.